In my Fall Boots post, I mentioned how I bought my boots with blow money and I'm sure that sparked a lot of interest as to what the heck I was talking about! First off, get your mind out of the gutter…yep I caught you.

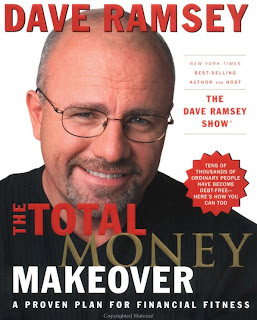

The term "blow money" was originated by Dave Ramsey, a financial guru. Last year, my husband and I took the class Financial Peace through our church, ultimately it's a Christian based financial class that teaches you to "live like no one else, so you can live like no one else." If that sounds like mumble jumble, in laymen's terms, Dave (yea we're on a first name basis now) tells you to live cheap, save for what you want and pay for that with cash – no credit cards, no debt. Every cent you will spend for the month is accounted for and a cash budget is set. He also teaches you about how to pay off college loans (or other debt) with "gazelle intensity", how to invest for the future and also very importantly, to give. I would highly advise anyone to take this class – it is for everyone, whether rich, poor, educated/uneducated in finance, etc. The best part about having a cash budget, is that at the beginning of each month you already know exactly how much you're spending for that month – money is only flowing in at this point, no more is going out.

I think the most important thing we took from the class was the "blow money" idea. We took Dave's idea of blow money ($ for misc items) and bundled it with other areas of spending such as entertainment, eating out, etc. Our version of blow money gives people the freedom to spend money on whatever they want, whenever they want – oh what's the catch? You only get a limited amount of money for this per month, but you decide what this amount is depending on where you're at in the big financial picture. The #1 reason why couples, especially, should have blow money is because each person has their own blow money (each has equal amount) and they can buy whatever they want – no more complaining about your husband going to subway yet again or your wife buying an $8 nail polish that she doesn't need (blow money works great for single people too). It's about what you want. The #2 reason why it's important is because spending on entertainment and eating out can become astronomical. A lot of social interactions revolve around spending money and that gets expensive. Going out to eat, grabbing a coffee, going to the movies, fundraiser events, drinks after work, going bowling, snack on the road trip, soda from the machine, shopping with the girls, the list could go on forever. When you have a set amount of blow money in cash, you can visually see how much money you have left for the month. It will help determine, do you really want to see that movie in theaters or would you rather wait until you can Redbox it? Because when this money is gone, it is GONE – no more money for going out, eating out or leisurely shopping.

Now, how is this going to help you become more successful? Less money spent in one area, equals more money saved for another. Think how much faster you could pay off your student loans if you put an extra $100+ towards them every month. If you're paying just the minimum on your loans every month, you're barely even making a dent. No debt? How nice would it be to buy a car in cash, instead of financing it? What about paying for a wedding in cash? Taking more vacations? Yea…you get the picture.

Live like no one else, so you can live like no one else.

No comments:

Post a Comment

Comments appreciated!